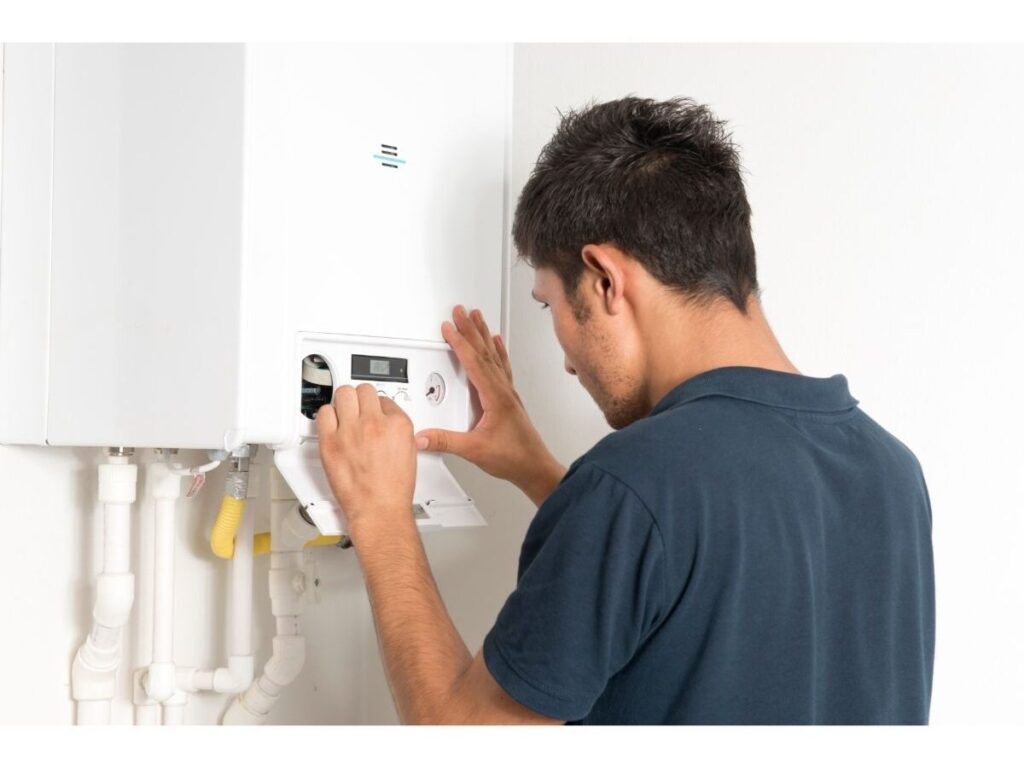

If you’re a landlord, you know how important it is to have reliable boiler cover. Not only does it protect your investment, but it also ensures your tenants have access to hot water and heating when they need it. With so many options available, it can be challenging to choose the best landlord boiler cover for your needs. Here’s where we can help.

When comparing landlord boiler cover, it’s important to consider factors such as price, coverage, and customer service. While some policies may be cheaper than others, they may not offer the same level of protection or support. By doing your research and comparing multiple options, you can find the best landlord boiler cover for your specific needs and budget.

Importance of Landlord Boiler Cover

Having reliable landlord boiler cover in place is critical for any property owner renting out their home. While boiler cover is not legally required, there are several compelling reasons why landlords should strongly consider investing in a policy.

Peace of Mind

One of the biggest benefits of landlord boiler cover is the peace of mind it provides. Knowing you have a policy to cover repairs in case of a boiler breakdown can give you confidence as a landlord.

Without cover, an unexpected issue like a broken boiler could leave you with a huge unanticipated repair bill. This could amount to hundreds or even thousands of pounds if parts need replacing or the entire boiler needs to be swapped out.

With the right boiler policy, you can avoid panicking about these unpredictable and costly repairs. Covered breakdowns will be fixed or replaced without you having to worry about the expense.

Cost Savings

While paying for landlord boiler cover does come with a monthly or annual cost, it can end up saving you money in the long run.

If you need to pay for just one major boiler repair out of pocket, it could easily exceed the total yearly cost of a cover policy. Breakdown cover means you avoid most or all of these repair costs throughout the year.

Over several years of renting out your property, a good landlord boiler policy can save you thousands compared to paying for repairs as they happen.

Compliance with Regulations

There are several regulations landlords must comply with when renting out their property. Having boiler cover helps ensure you can meet these obligations as a landlord.

For example, as a landlord you must by law:

- Maintain a safe and working boiler and heating system

- Provide reliable hot water supply for tenants

- Carry out annual gas safety checks

A comprehensive boiler cover policy will usually include annual safety inspections and certificates to satisfy legal requirements. It also gives you access to engineers for any urgent repairs needed to keep your tenants’ heating and hot water running properly.

Keeping Tenants Happy

Happy tenants lead to long tenancies and good relationships. Boiler cover plays an important role here.

If the boiler breaks down, your tenants may be left without heating or hot water until the issue can be fixed. Understandably, this can severely impact your tenants’ satisfaction.

With a cover policy, engineers can typically respond and resolve boiler problems much more quickly. This avoids lengthy disruptions that could upset your tenants.

Keeping your tenants comfortable and avoiding problems from boiler breakdowns is essential. Landlord boiler cover helps make this possible.

While landlord boiler cover does come with a cost, it provides essential protection and benefits that make it well worth considering for rental properties. The peace of mind, potential cost savings, compliance with regulations, and tenant satisfaction it enables make cover highly recommended for landlords.

Types of Landlord Boiler Cover Policies

There are a few main options available when it comes to landlord boiler cover policies. The level of protection and inclusions will vary between these different policy types.

Boiler-Only Cover

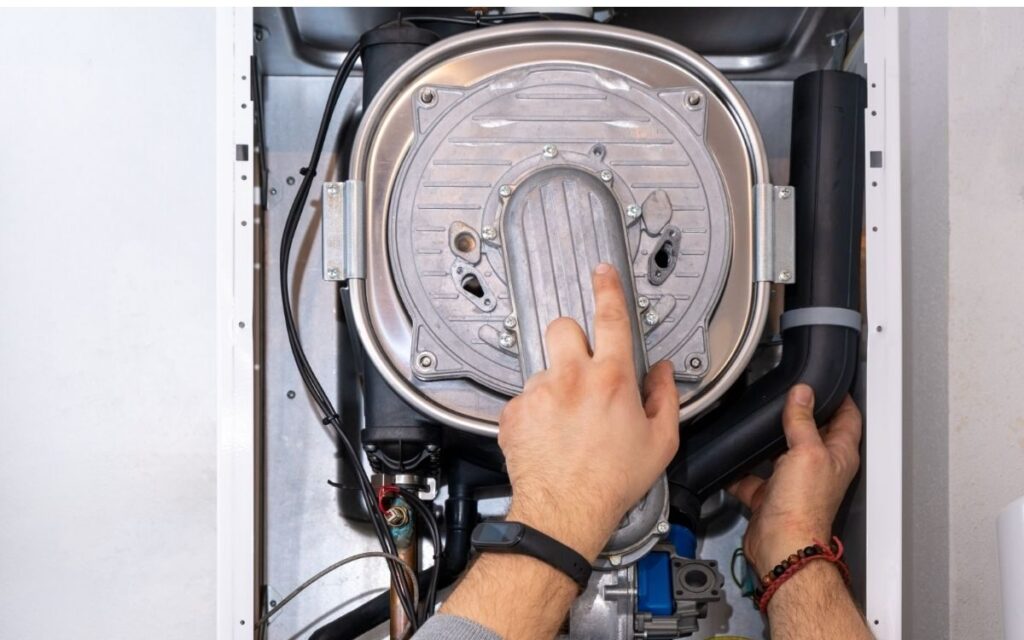

This is the most basic and affordable type of landlord boiler cover. As the name suggests, boiler-only cover will only cover your boiler itself and its controls.

This means any issues or breakdowns with the physical boiler unit or heating controls like a programmer, thermostat, valves, etc. will be covered.

However, a boiler-only cover policy does not include other parts of your heating system. Repairs to radiators, pipes, or hot water cylinders would not be covered under this type of policy.

Boiler-only cover is a good option for landlords looking for breakdown protection just for their rental property’s boiler unit. It provides essential cover while keeping costs down.

Boiler and Heating Cover

This is a more comprehensive type of landlord boiler cover than boiler-only policies. Boiler and heating cover protects both the boiler itself and the wider heating system.

Along with the boiler unit, this type of cover will also include:

- Central heating pump

- Radiators

- Pipes

- Hot water cylinder

Repairs and breakdowns to any part of the boiler or heating system listed above will be covered. This provides wider protection for your rental property’s whole heating setup.

However, boiler and heating cover costs more than just boiler-only cover due to its wider inclusions.

Home Emergency Cover

This is the most extensive type of landlord boiler cover available. Home emergency cover policies provide protection for urgent issues across various systems in the property, including:

- Boiler

- Heating

- Plumbing

- Electrics

- Drainage

In addition to your boiler and heating, home emergency cover can also pay for repairs to things like damaged pipes, blocked drains, leaking tanks, damaged wiring, and more, depending on your policy.

This broad protection comes at a cost – home emergency cover is the most expensive form of landlord boiler cover. However, for maximum peace of mind it is worth considering, especially for older properties more prone to issues.

In summary, reviewing these main landlord boiler cover policy types – boiler-only, boiler and heating, and home emergency – allows you to choose the right level of cover for your rental property’s needs and budget.

Pricing Details for Landlord Boiler Cover

The cost of landlord boiler cover can vary quite a bit between different providers. Here are some example price ranges for common policy types:

Boiler-Only Cover

For basic boiler-only cover, expect to pay between £10 – £20 per month on average. Some providers offer policies starting under £10 per month.

Monthly premiums will depend on factors like:

- Your boiler’s make, model, and age

- Your chosen excess amount

- Your location

Boiler & Heating Cover

For wider boiler and heating cover, monthly prices are typically £15 – £30 per month. More inclusions mean higher premiums.

As with boiler-only cover, the specifics of your property and policy options will impact the price.

Home Emergency Cover

Home emergency cover is the most expensive policy type, with average monthly costs from £25 up to £40 per month in some cases.

The higher cost reflects the wider range of emergency issues covered beyond just boiler breakdowns.

To summarize, typical starting prices for common landlord boiler cover policies are:

| Policy Type | Average Monthly Price |

|---|---|

| Boiler-Only Cover | £10 – £20 |

| Boiler & Heating Cover | £15 – £30 |

| Home Emergency Cover | £25+ |

Check a range of landlord boiler cover providers to compare quotes and find the most competitive price for the level of cover you need.

Common Inclusions and Exclusions in Landlord Boiler Cover

When choosing a landlord boiler cover policy, it’s important to understand what is included and what is not covered. Let’s look at some typical inclusions and exclusions.

Standard Inclusions

Most landlord boiler cover policies include:

- Breakdown repairs – cover for fixing or replacing broken boiler components

- Service & maintenance – annual safety checks and tune-ups

- Call-outs – home visits from engineers to assess and repair faults

- Parts & labor – replacement parts and engineer fees

Depending on your cover level, you may also get:

- System controls – programmer, thermostat, valves

- Radiators – repair or replacement of damaged radiators

- Pipes – repair of leaks in internal pipework

- Hot water cylinder – repair or replacement of faulty cylinders

Home emergency cover sometimes includes:

- Plumbing & drainage – leaky pipes, blocked drains

- Electrics – damaged wiring, circuit breakers

- Pest control – removal of pests like wasps, rats

- Security – replacement locks, doors, windows

Common Exclusions

While inclusions vary, most standard landlord boiler cover excludes:

- Pre-existing faults – issues present before policy start

- Lack of maintenance – damage due to poor upkeep

- Accidental/intentional damage – damage caused deliberately

Some policies also exclude:

- Scale & sludge removal – from lack of water treatment

- Upgrades or improvements – upgrades not due to breakdowns

- Extended wait times – policies often have a waiting period before you can make a claim

Home emergency cover may exclude:

- Wear and tear – gradual deterioration from age/use

- External issues – e.g. a tree root blocking a drain

Check your policy documents for the specific inclusions, exclusions and limitations that apply. Always get clarification from your provider if you are unsure about cover for a specific repair or issue.

Comparing Top Providers for Landlord Boiler Cover

When picking a landlord boiler cover provider, you’ll want to compare factors like cost, coverage, reliability, and customer service. Here is an overview of top options:

Leading Landlord Boiler Cover Providers

| Provider | Monthly Cost | Cover Levels | Excess | Benefits |

|---|---|---|---|---|

| British Gas | £16-£30 | Boiler Only, HomeCare 2-4 | £99 | Wide coverage, familiar brand |

| HomeServe | £13-£35 | Boiler & Heating, Plumbing & Drains, Home Emergencies | £100 | Broad inclusion options |

| Direct Line | £13-£24 | Boiler Only, Plumbing & Drainage | £50-£500 | Competitive pricing, online claims |

| SSE | £15-£24 | Boiler, Heating & Plumbing, Home Emergency | £100 | Rewards program discounts |

| EDF | £9-£24 | Boiler Only, Home Emergency | £50-£100 | Lower excess charges |

British Gas is one of the most widely recognised and used boiler cover providers. They offer different package levels and competitive pricing. Their HomeCare plans are comprehensive but can be more expensive.

HomeServe gives you flexibility to customize your ideal cover inclusions across boiler, plumbing, drainage, and more. Wide range of options available.

Direct Line specializes in boiler cover and gives online claims capabilities. Very reasonable pricing but limited compared to wider home emergency cover.

SSE provides boiler cover bundled with other home services. Member rewards program allows you to earn money back.

EDF focuses on boiler cover primarily. Their boiler-only plans are very affordable but inclusions beyond that are more limited.

Key Considerations

When comparing providers, look at:

- Cost – premiums, call-out charges, excess fees

- Inclusions – repairs, services, controls, appliances covered

- Exclusions – damage types, parts, and services not covered

- Ease of claims – online/phone claims, speed of response

- Customer service – reviews, ratings, complaints

Take time to thoroughly compare multiple landlord boiler cover options to find the best value provider for your needs.

Landlord Boiler Cover with Multiple Properties

If you are a landlord with multiple properties, you need to make sure that all of your boilers are covered. This can be a daunting task, but there are boiler cover companies out there that can help you. When looking for boiler cover companies, it is a good idea to start by looking for companies that have affiliate programs. This way, you can earn money while also ensuring that your boilers are covered.

When comparing boiler cover companies, you should look at the following:

- The cost of the policy

- The level of cover provided

- The excess you will have to pay in the event of a claim

- The call-out fee for engineers

- The response time for call-outs

Some boiler cover companies offer discounts for landlords with multiple properties. It is worth checking with the companies you are interested in to see if they offer any discounts.

Another thing to consider is whether the boiler cover company offers a 24/7 helpline. A 24/7 helpline can ensure that any issues are dealt with promptly, no matter what time it is.

Finally, make sure that the boiler cover company you choose has a good reputation. Look for reviews online and ask other landlords for recommendations. You need to be confident that the company you choose will provide a good service and be there when you need them.

Landlord Boiler Cover with CP12

If you’re a landlord, you’re responsible for ensuring that the gas appliances in your rental property are safe for your tenants to use. This means you need a Gas Safe registered engineer to carry out an annual gas safety check and issue a CP12 certificate. It’s also a good idea to have boiler cover in place to protect your investment and keep your tenants happy.

When looking for landlord boiler cover, it’s important to find a policy that includes a CP12 certificate. Here are some of the best options available:

| Company | Price | CP12 Included? |

|---|---|---|

| HomeTree | £17.45 per month | Yes |

| Your Repair | £12 per month | Yes |

| WarmZilla | £17.50 per month | Yes |

HomeTree’s Landlord Cover policy includes an annual boiler service and a CP12 certificate, as well as cover for boiler repairs and parts. It offers a similar package with their YourHeating package, which also includes an annual boiler service and a CP12 certificate, as well as cover for central heating repairs and parts in addition to the boiler and controls.

YourRepair’s Landlord Heating plan, starting at £12 per month, covers the boiler and controls as well as a gas safety inspection. For £14 per month, it includes central heating cover too.

WarmZilla’s ‘Extra’ Plan gives you the same benefits mentioned above for £22.50 per month.

When choosing a landlord boiler cover policy, make sure you read the terms and conditions carefully to ensure that the policy meets your needs. It’s also a good idea to compare prices and check customer reviews to find the best option for you.

Are Boilers Covered with Landlord Insurance?

As a landlord, you may be wondering if your boiler is covered by your landlord insurance policy. The answer is not straightforward, as it depends on the type of policy you have. Generally, standard landlord insurance policies do not include boiler cover as standard. However, some policies may offer boiler breakdown cover as an optional extra.

If you want to ensure that your boiler is covered, it is worth considering specialist landlord boiler cover. This type of insurance is designed specifically for landlords and can provide cover for boiler repairs, replacement, and maintenance.

It is important to note that while landlord insurance may cover your boiler in the event of an emergency, it typically does not cover regular servicing or maintenance. This means that you may need to arrange for a qualified engineer to service your boiler annually to ensure that it is in good working order.

When looking for landlord boiler cover, it is worth considering the level of cover provided by different policies. Some policies may only cover the boiler itself, while others may also cover the heating system, radiators, and pipework. It is important to choose a policy that provides the level of cover that you need.

Additionally, you may want to consider the excess that you will need to pay in the event of a claim. Some policies have a higher excess than others, so it is important to compare policies carefully to ensure that you are getting the best deal.

In summary, while standard landlord insurance policies may not include boiler cover, it is worth considering specialist landlord boiler cover to ensure that your boiler is protected. When comparing policies, consider the level of cover provided, the excess, and any additional benefits or features offered.

Top Landlord Boiler Cover Providers Compared

Hometree

Hometree is a popular choice for landlord boiler cover due to their affordable pricing and comprehensive coverage. Their policies cover boiler breakdowns, repairs, and even annual servicing. They also offer a 24/7 helpline for emergencies and a range of additional options such as home emergency cover and plumbing and drainage cover.

With Hometree, you can choose from three different levels of cover, each with varying levels of protection and excess fees. Their policies start at just £17.45 per month, making them an affordable option for landlords looking for peace of mind.

Your Repair

Your Repair is another great option for landlord boiler cover. Their policies cover boiler breakdowns, repairs, and annual servicing, as well as additional options such as home emergency cover and plumbing and drainage cover. They also offer a 24/7 helpline for emergencies and a network of qualified engineers.

Your Repair offers three levels of cover, all with competitive pricing and low excess fees. Their policies start at just £12.50 per month, making them an affordable choice for landlords.

WarmZilla

WarmZilla is a popular choice for landlord boiler cover due to their comprehensive coverage and competitive pricing. Their policies cover boiler breakdowns, repairs, and annual servicing, as well as additional options such as home emergency cover and plumbing and drainage cover. They also offer a 24/7 helpline for emergencies and a network of qualified engineers.

WarmZilla offers three levels of cover, each with varying levels of protection and excess fees. Their policies start at just £17.50 per month, making them one of the most affordable options for landlord boiler cover.

British Gas boiler cover

There are several reasons why someone may not want to choose British Gas boiler cover. Firstly, their prices tend to be higher than other providers in the market, which can be a deterrent for some customers. Additionally, their call-out times can be longer than other providers, meaning that customers may have to wait longer for an engineer to arrive in the event of a breakdown.

Finally, some customers have reported poor customer service experiences with British Gas, which can be frustrating and time-consuming to deal with.

Should I get boiler cover from my energy supplier?

Using the boiler cover provided by your energy supplier may not always be the best idea for several reasons. Firstly, the prices for energy supplier-provided boiler cover can be higher than other providers in the market, which can be a deterrent for some customers. Additionally, energy suppliers may not have the same level of expertise and experience in repairing and maintaining boilers as specialist boiler cover providers, which could result in longer repair times or even further damage to the boiler.

Finally, energy suppliers may have limited availability for call-outs, which could mean longer wait times for customers needing urgent repairs. Therefore, it is important for customers to research and compare different boiler cover providers to find the best option for their needs.

Energy suppliers usually don’t have their own team of engineers to repair boilers, which means the service may not be as good. Just because they supply your energy, it doesn’t mean they are experts in repairing your particular boiler. So it’s important to be careful when considering using the boiler cover provided by your energy supplier. Instead, take some time to do your research and find a reliable boiler cover provider that is best suited to your needs.

Conclusion

Choosing the right landlord boiler cover can be a daunting task, but it is essential to ensure that your tenants are warm and happy, and your property is protected in case of problems. We recommend that you consider the following factors when choosing a policy:

- Price: Make sure you compare quotes from different providers to find the best deal for you.

- Coverage: Check what is covered by the policy, including breakdowns, annual servicing, and replacement boilers.

- Excess: Consider the excess you will have to pay in the event of a claim.

- Customer service: Look for a provider with good customer service and a quick response time.

- Affiliate programs: Consider boiler cover companies which have affiliate programs.

After researching and comparing the top landlord boiler cover providers, we recommend that you consider HomeTree, YourRepair and Warmzilla. These providers offer comprehensive coverage, good customer service, and very competitive prices.