By getting boiler insurance cover, with a nationwide network of Gas Safe Registered engineers, you benefit from parts and labour, unlimited callouts, and a 24/7 emergency helpline if your boiler breaks down. If you’re looking for the best deals on boiler insurance, there are a few things you need to keep in mind. Here, we take a look at some important factors when comparing deals.

How to look for boiler cover

Be sure to compare the same type and size of boiler, the same level of cover, and the same excess. Second, don’t just go for the cheapest cover, be sure to read the small print and that you’re getting the cover you need. Third, remember that the best deals are often found online. So shop around and compare quotes from a few different insurers before you buy.

What is Boiler Insurance Cover?

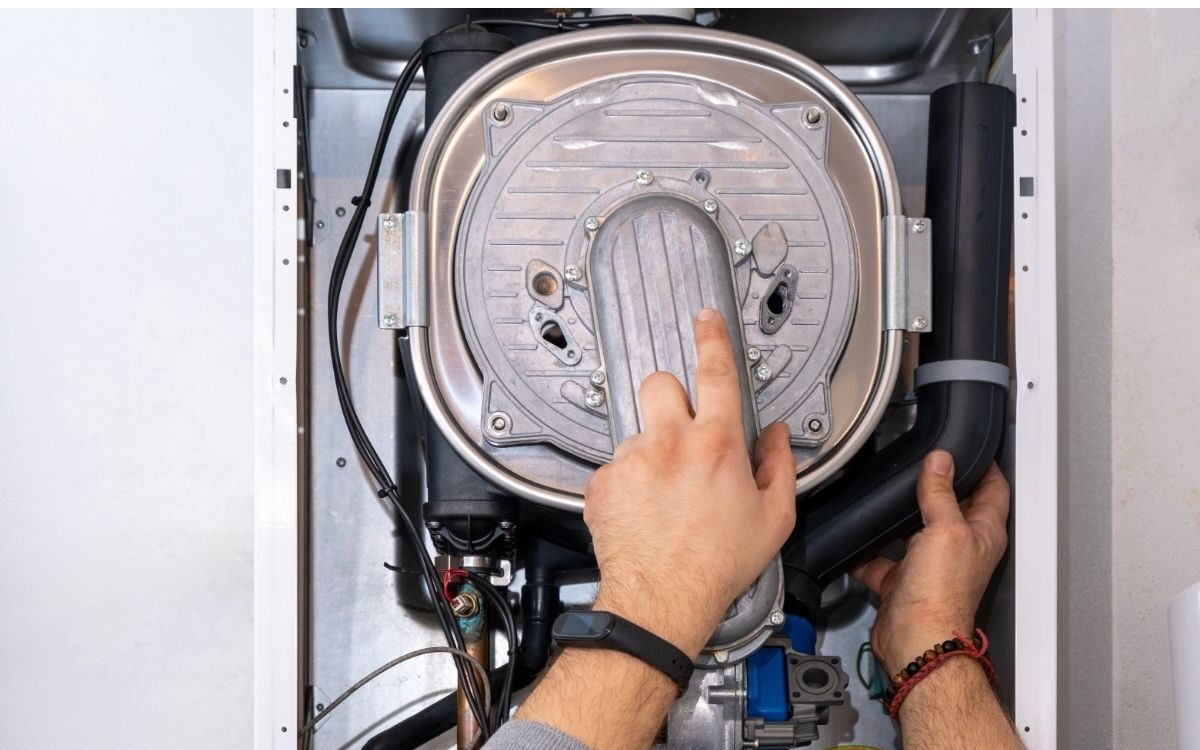

Boiler Insurance is a policy that you can purchase to protect your boiler if it breaks down. It can provide you with the assurance that if your boiler fails, a gas-safe registered engineer will assess and attempt to repair the problem.

Some boiler cover policies also include boiler servicing, which means an engineer will service your boiler on an annual basis to ensure it is in good working order, even if it hasn’t broken down up to now. Many companies now perform annual servicing of boilers in the summer, when there are less breakdown callouts.

Types of boiler insurance policies

The following boiler insurance products are available:

- Cover for central heating system and the boiler.

- Cover for boiler only.

- Cover for electrical, plumbing, and heating breakdowns.

- Boiler insurance services for landlords.

Factors to look at when comparing boiler insurance cover

The Size and Type of Boiler

When it comes to boiler insurance in the UK, there are a few things to consider. The size of your boiler, the type of boiler and the age of your boiler are all important factors to take into account when getting a policy.

The size of your boiler is important because it will affect the amount of money you pay for your policy. If you have a smaller boiler, you will likely pay less for your policy than someone with a larger boiler, because a smaller boiler often means it is connected to less radiators in the house, and overall, the demand will be less.

The type of boiler you have is also important. If you have a gas boiler, you will likely pay more for your policy than someone with an electric boiler. This is because there are more moving parts in a gas fired boiler which are prone to degrade through wear and tear and blockages.

The age of your boiler is also a factor. If you have an older boiler, you will likely pay more for your policy than someone with a newer boiler. Often, premiums start going up after a boiler is 7 years old and boiler insurance cover is usually not offered for boilers over 15 years old.

Read the Boiler Insurance Small Print

It’s a good idea to compare boiler insurance cover before you buy it. There are a few things to look for when you’re comparing policies.

First, check the cover. Some policies will only cover the boiler itself, while others will cover the boiler and the central heating system. Make sure you know what’s included in the cover you’re considering. Insurance cover for boiler and central heating systems – which includes radiators, pipework and fittings, are normally more expensive than a boiler only cover.

Think about how often your central heating breaks down compared to just the boiler. If you know how to bleed a radiator and tighten some fittings you may not need to pay more.

Second, check the excess. This is the amount you’ll have to pay if you make a claim.

The higher the excess, the lower the premium, but you don’t want to be left out of pocket if you have to make a claim.

An excess is £50 per claim is common and this is charged whether the issue is sorted in the first visit or after many. If your boiler is prone to breaking down, consider getting cover without an excess even though it may be a higher premium.

Alternatively, if your boiler is relatively new and has just come out of warranty, you may want to try a year or two on a lower premium with an excess.

Third, check the cover limits. Some boiler policies have a limit on the amount they’ll pay out for each claim, and some have a limit on the total amount they’ll pay out over the life of the policy. Make sure you know what the limits are before you buy.

Finally, check the small print. Some policies have exclusions or conditions that you might not be aware of. Make sure you read the small print carefully so you know what you’re buying.

What does boiler insurance cover exclude?

Exclusions from boiler and heating cover are common. Typical exclusions are:

- Mobile homes.

- Commercial premises.

- Bedsits.

- Boilers not properly maintained with annual checks

- Boilers over a certain age.

Get the best boiler insurance deals by comparing online

When it comes to boiler insurance, it pays to do your research and shop around for the best deals.

There are a number of different providers of boiler insurance, and each one offers different levels of cover and different prices. To get the best deal on boiler insurance, it is important to compare the different policies on offer from a variety of different providers.

There are a number of websites that allow you to do this, and it is worth taking the time to do some research before making a decision. When you are comparing boiler insurance policies, there are a few things you should look for.

Firstly, you should make sure that the policy you are considering covers your boiler for the type of fuel it uses. It often defaults to gas or LPG as these are the most widely used fuels. But check for oil boilers if you have one of these.

Secondly, you should check to see what kind of cover is included in the policy. There are many different versions of boiler insurance.

Thirdly, you should check the excess that you would have to pay in the event of a claim. If you’re willing to pay for extra peace of mind, go with one that doesn’t have an excess. Or you can risk it with a lower premium and an excess per claim, and these are usually the cheapest policies.

Fourthly, you should check to see if there is a limit on the amount of money that you can claim under the policy. Often, each callout is limited to £1000 that includes parts and labour.

Some parts within a boiler can cost as much as £700 and if one of these needs replacing, along with labour costs could take you over the limit. In which case you will have to pay the extra.

Although this doesn’t happen often, you should be aware of these limits and ask the provider to clear things up.

Finally, you should check the terms and conditions of the policy to make sure that you are happy with them. Call the provider if you are unsure of any part of the contract and ask them to clarify each point before buying cover.

This way, you can be sure that you are getting the best deal possible. And don’t forget to review your policy regularly. Boiler insurance policies can change, so it’s important to keep up to date with the latest deals. Don’t just let policies overrun and auto renew. You may be able to find a better deal by doing annual comparisons.

By following these tips, you should be able to find the best deals on boiler insurance and have peace of mind for another year.

Read related articles: