Getting boiler cover seems like an easy way to avoid expensive repair bills down the road. But is paying for ongoing cover truly worth the price you’ll pay over time?

The answer for most homeowners is no. Industry data reveals boiler cover is rarely a good value. You’ll typically spend far more on premiums than you would just paying for repairs as needed.

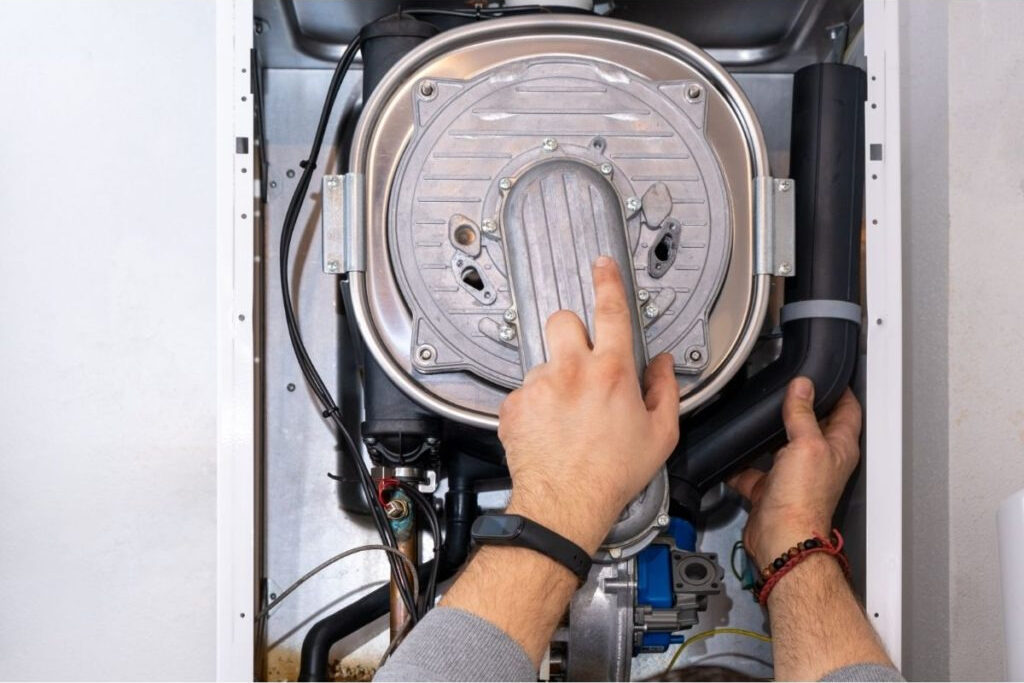

Boiler cover plans provide insurance for the cost of a boiler breakdown, and they can include an annual service so you don’t have to spend money to fix the boiler and central heating parts in a breakdown. As some parts inside a boiler cost hundreds of pounds, many customers consider it vital to take out a boiler cover plan.

Is Boiler Cover Worth it?

You’re often better off putting those monthly premiums into a repair fund instead. Combine this with regular boiler servicing and purchasing a reliable brand with an extended warranty for the most cost-effective approach.

Before committing to boiler cover, be sure to read the fine print, shop around annually, and check your home insurance – you may already have coverage. With the right prep, you can save significantly while still protecting your budget from surprise boiler bills.

Best Boiler Cover: Protecting Your Investment

Big Price Hikes on Renewals

Boiler cover providers lure in customers with low introductory rates. But they punish loyalty by jacking up prices significantly at renewal time.

For example, HomeServe charges £100 the first year then doubles the premium to £210 the second year.

British Gas hits long-time customers the hardest. Their prices are 19% higher after just 3-4 years compared to other boiler cover providers.

Boiler Cover For Old Boilers: Is It Worth It?

What To Do Before Buying Boiler Cover

Pay for Repairs Instead of Premiums

The average yearly boiler cover premium is around £300. But 50% of households won’t face any repair costs in a given year.

Paying for repairs and annual servicing as needed costs far less for most homeowners.

Boiler cover only benefits 6% of customers in the event of breakdowns based on typical repair costs.

Use a Repair Fund as a Safety Net

For budgeting peace of mind, put the money you’d spend on premiums into an emergency repairs fund instead.

Aim to save around £500-£1000 to cover potential boiler issues. This self-insures against surprise bills.

Mind the Policy Exclusions

Boiler cover seems comprehensive but has major exclusions. Equipment like radiators and pipes often aren’t covered.

Pre-existing issues or faults related to original installs are also excluded. Read the policy carefully before paying.

Check Your Home Insurance First

Many home insurance policies include boiler breakdown coverage and repairs.

Add this as an option if it’s not standard. Then you won’t require separate boiler cover.

Focus on Prevention with Service Plans

Rather than cover, invest in annual boiler servicing from a Gas Safe engineer.

Proper maintenance prevents many breakdowns and extends the boiler’s lifespan.

Shop Around Annually for the Best Deal

Don’t just accept the costly renewal quote. Run quotes with other insurers annually to find cheaper boiler cover.

Be ready to switch providers if your current company won’t budge on price. This forces them to compete for your business.

Best Landlord Boiler Cover: A Comprehensive Comparison

Buy a Reliable New Boiler Brand

Avoid future repair bills by choosing a top brand like Worcester Bosch or Vailant with a 5+ year warranty.

Stick with established boiler makes rather than cheap unknown brands.

Boiler cover often costs far more than just paying for repairs as needed. Shop around, read the fine print, and invest in servicing for true peace of mind without overpaying.

When to get boiler cover

You can’t afford an unexpected big repair bill

Boiler repairs can be expensive so having boiler cover to make sure you don’t have to pay a big bill for an unforeseen breakdown will be beneficial if you can’t afford these big one-off bills.

If you have vulnerable family members

If you have any vulnerable family members such as the elderly or very young who will find it difficult or even a risk to health coping without hot water and heating. It is best to get boiler cover as usually, the provider can get an engineer out to you more quickly, as most have priority service call outs for vulnerable customers.

You can check this when looking for the right provider.

Your boiler breaks down often

If your boiler regularly breaks down, due to age or just poor manufacturing, it would be a good idea to get boiler cover, especially one that has a low excess, unlimited callouts and which includes parts and labour.

As many policies include an annual service, many customers find their boiler lifespan is increased too by a couple of years because having an older boiler without any cover usually leads to some customers not bothering with an annual service.

Does Home Insurance Cover Boiler Repair And Breakdown?

How to save money on boiler repairs

As the weather gets colder, the last thing you want is for your boiler to break down. Boiler repair can be expensive, so it’s important to know how to save money on boiler repair. Firstly, it’s important to have your boiler regularly serviced.

This will help to prevent any problems developing and will also give you the opportunity to get any small problems fixed before they become big and expensive problems.

Secondly, if you do have a problem with your boiler, try to fix it yourself if you can. There are a lot of helpful videos and articles online that can show you how to do simple repairs. Of course, if you’re not confident in doing the repair yourself, then it’s best to call in a professional.

Thirdly, if you do need to call in a professional, make sure to get multiple quotes before you decide on which company to use. Also, ask around for recommendations from friends or family.

Finally, make sure to keep your boiler well-maintained. This means bleeding the radiators, checking the boiler pressure and topping up the water levels. By doing this, you’ll be less likely to experience a breakdown and will save money in the

When not to buy boiler cover

You are a tenant in a property

If you are renting your property then you don’t need to buy a separate boiler cover and your landlord should take care of any breakdowns or faults with the central heating system.

Also, check your home insurance policy cover as it may cover at least some of the same things a boiler cover does so you may not need to take out the most expensive boiler breakdown policy, but can opt for a cheaper one.

If your boiler has already broken down

If you haven’t already got boiler cover with anyone and your boiler breaks down, you should remember most policies don’t start at the time you take out the insurance.

They only start one month later and even then, usually after an engineer has come out to check it’s in working order in the first place. Check the small print in the terms and conditions.

You have bought a new boiler recently

Many newly installed boilers come with up to 10 years parts and labour warranty with only an annual service needed to keep the warranty valid, so you won’t need to get additional cover for this period.

With the average cost of an annual boiler service being £70, it is much cheaper than most boiler covers charge in a year.

Summary

It would be a good idea to get boiler cover if any of the following apply to you:

- You can’t afford and unexpected big repair bill.

- If you have vulnerable family members.

- Your boiler breaks down often.

- If you live in a hard water area

Whether you choose to take out boiler cover or not, always check the terms and conditions of the boiler warranty, home insurance policy, and the boiler cover policy as the details in these will help you decide what you need and what you don’t need.

At the end of the day, with boiler cover, you are paying for peace of mind and everyone has a different tolerance for how long they can be without hot water and heating.

If you are looking for boiler cover straight away, check our recommended page to see why we recommend YourRepair.co.uk to give you an instant quote: